|

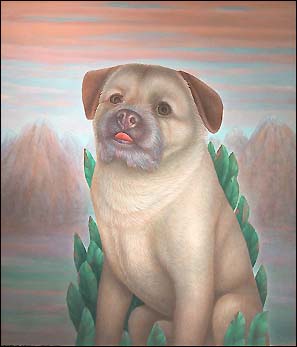

*) Clebs [kleps]. n. m. (Kleb, 1863; arabe kleb « chien »). Pop. Chien. (On dit aussi clébar [klebaR].) « Une masse surexcitée assomma le clébard » (COURCHAY). (With many thanks to Petit Robert, Dictionnaire de la langue française.) This little urchin of a dog as depicted by Anneke van Brussel was rejected by its own mistress - as a painting, that is. It never occurred to the lady in question that in turning down the portrait, she might be missing out on a not insignificant appreciation in value, this not being the sort of thing your genuine aficionado tends to be concerned with - and quite rightly so, I hasten to add. However, this will change dramatically the moment the dog's discerning mistress realises she's no longer in a position to buy the painting. Once it hits her that someone else might cash in on "her" painting at some future date, she'll start feeling terrifically peeved: after all, there wouldn't have been a painting in the first place if it hadn't been for her doggie. A doggie moreover which won't live forever, and that's the sort of thing one's conscience tends to latch on to and start gnawing away at. And it's not as if the little dog looked all that jolly in the first place … |

|

One of the previous issues of Weekly Residuum was headed "Off Sector" - a

slightly rash decision on my part, it now seems. But let's not get ahead of

ourselves. As you know (as one of my readers, how could you have failed to

notice?) I am fascinated by the Internet and, more generally, by all things

digital. Not that I invest in it the way one would in IT shares (let's face

it, if there's one area in which venture capital has been around for

decades, surely it would have to be the art business). It's just that it's

such wonderful fun to see one's personal productivity expand by leaps and

bounds as one learns how to fool around with the new technologies - fooling

around as such being great fun, of course. And so I hear myself tut-tutting

while reading the current reports on the collapse of the IT industry,

although of course it cannot be denied that there's plenty of room for

fine-tuning there - after all, true adventure seldom triumphs if it isn't

for the deep suffering on the part of all soldiers of fortune, who

invariably have to experience first that it's not all gold that glitters.

And so it came as a bit of a shock to me (although funnily enough I had sort of seen it coming) that the stakeholders in Maurice de Hondt's** |

|

high-profile listed company, Newconomy, had run out of patience with the supreme leader

of their particular universe. I couldn't help wondering whether these people

had ever bought a painting and if so, what had gone through their mind while

doing so. I instantly found myself redressing the balance - after all, I

would hate it if you started thinking that I empathise with Maurice de Hondt

the way I do with paintings. (Willem Vermeend, the former State Secretary

for Finance who is the architect of the tax overhaul just having come into

force in the Netherlands under the heading "Tax Review 2001", must have

sensed it by keeping the paintings you love so dearly exempt from wealth tax

for the time being.) With which I have implied quite unintentionally that

genuine venture capital investment is conditional on a sense of affinity

with the shop floor - as well as patience, and thus, a certain amount of

funds to your name.

Mind your own business, I hear some of you think. Alright then - resort to the subsidised art buying scheme***) if you have to, it serves a worthy cause as well as enabling you instantly to pocket the return. ***) The "Kunstkoopregeling" is one of those schemes that only the Netherlands could come up with. Put succinctly, the (privatised) scheme is aimed at enhancing the market mechanism from the vantage point of the artist by inviting art buyers to apply for an interest-free loan towards the purchase of the work of art of their choice. Provided the loan is approved by the bank charged with handling the financial side of things and the art gallery which is selling the work of art has the blessing of the foundation in charge of the artistic aspects, the upshot of the whole mechanism is that the gallery gets paid the price of the work of art (and so, therefore, does the artist) while the work's new owner happily toddles off home, painting under arm. How's that for instant return on one's investment?! |

**) This translates rather neatly into "Morris the Dog" (and we mean that in a caring way). |

BACK